- Be sure to have your military ID and you will proof solution able. Your personal safeguards count and you can long lasting address are also necessary.

- Delivering numerous address where you are able to getting contacted is very important so you’re able to ensure that the lender you’re taking out of the loan away from keeps in touch with your, wherever you are stationed (e.g., your family home, your military legs).

- Get a duplicate of your own credit file you could provide with the lender, if needed. Of numerous loan providers accomplish that in your stead.

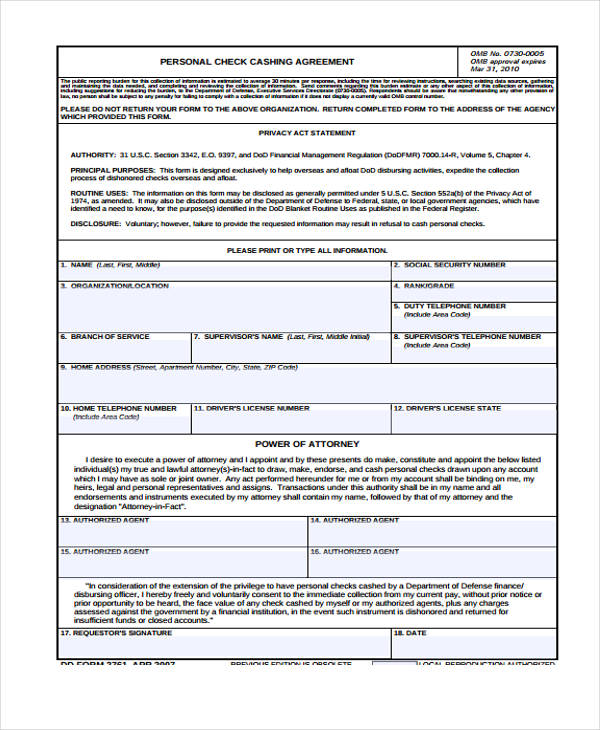

- If you’re unable to signal your loan documents myself, make sure to assign an electricity of attorneys so you’re able to someone who can get it done for you. Notarization may be needed in some states.

The requirements having Financing Recognition?

If you want an auto loan, don’t just roam on a car dealership. Becoming wishing and you may creating research ahead is vital to obtaining a low-notice loan.

A special auto loan software requires one fill in particular records to prove your income and private information, certainly additional factors. Here are the data you should fill out getting an auto loan.

step one. Earnings Facts

Loan providers typically need proof income to ensure consumers helps make its auto money. To meet up with this requirements, offer a cover stub less than you to definitely-month-dated showing their seasons-to-time income.

Taxation statements and you can financial statements are needed to possess mind-working individuals. Very loan providers want couple of years of income tax history, nonetheless they get request four. You will also you desire lender statements over the past 3 months.

2. Quarters Evidence

The lender need certainly to verify their target to your auto loan app. There are several solutions for your requirements to prove that you real time within address youre currently playing with, particularly a utility statement or other correspondence you get at your current target. A legitimate license is additionally expected if you plan so you’re able to push away having an auto.

3. Insurance Facts

Legislation stipulates that every vehicles away from home should be covered, so your financial need certainly to find out if you really have adequate visibility prior to giving the application. Get a hold of the insurance coverage ID cards or insurance policies report users and you can render them with one to the fresh new dealership.

You’re capable safer insurance coverage regarding dealership in the event the you don’t need to it already, even when. But not, for people who money owing to a seller, you will not have the ability to comparison shop for the best pricing. When you yourself have an effective reference to your own financial, you may find a better car loan price having a good preapproval auto loan than simply from the provider.

cuatro. Personality

Evidence of your own name is required to get an auto loan personal loan without a checking account. First off the applying, you will want a photo ID along with your signature, a recent domestic bill bearing an equivalent target since your ID, and two months regarding financial statements. Passports, government-awarded cards instance Medicare identification notes, inventory permits, and you will titles to home and other vehicle is actually appropriate forms of personality too.

5. Financial and you can Credit score

Also your existing and you will previous financial points, loan providers commonly consider carefully your obligations-to-money proportion (the new percentage of their gross monthly income one to goes toward paying your financial situation) plus credit rating and you will record.

Along with your earliest private information and you may concur, the financial institution can access this informative article instead of you being required to bring one thing. However, you should know that lender have a tendency to examine your most recent and you may earlier credit score.

six. Factual statements about the automobile

Once you apply for a used car mortgage, you’re going to have to promote enough facts about the new vehicle you should buy. The lender would want to understand the vehicle’s price, identity matter, seasons, generate, model, distance, fresh term and you may people liens to the automobile.